The Buzz on Feie Calculator

Wiki Article

Feie Calculator for Beginners

Table of ContentsSome Known Facts About Feie Calculator.Indicators on Feie Calculator You Should Know9 Simple Techniques For Feie CalculatorThe Greatest Guide To Feie CalculatorFeie Calculator Can Be Fun For EveryoneSome Ideas on Feie Calculator You Should KnowSee This Report on Feie Calculator

If he 'd regularly taken a trip, he would certainly instead finish Part III, providing the 12-month period he satisfied the Physical Presence Examination and his travel background. Action 3: Reporting Foreign Income (Component IV): Mark gained 4,500 per month (54,000 annually).Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Considering that he resided in Germany all year, the percentage of time he resided abroad throughout the tax is 100% and he gets in $59,400 as his FEIE. Finally, Mark reports complete incomes on his Type 1040 and enters the FEIE as an unfavorable amount on time 1, Line 8d, reducing his gross income.

Selecting the FEIE when it's not the most effective alternative: The FEIE may not be perfect if you have a high unearned income, make greater than the exemption restriction, or reside in a high-tax nation where the Foreign Tax Debt (FTC) may be more helpful. The Foreign Tax Debt (FTC) is a tax obligation reduction strategy usually utilized combined with the FEIE.

An Unbiased View of Feie Calculator

deportees to offset their U.S. tax financial debt with international revenue tax obligations paid on a dollar-for-dollar reduction basis. This implies that in high-tax countries, the FTC can usually eliminate U.S. tax financial obligation completely. Nonetheless, the FTC has restrictions on qualified taxes and the maximum claim quantity: Qualified taxes: Only earnings tax obligations (or tax obligations instead of revenue tax obligations) paid to international federal governments are eligible.tax obligation responsibility on your international revenue. If the foreign tax obligations you paid surpass this restriction, the excess foreign tax can normally be brought ahead for approximately 10 years or brought back one year (by means of an amended return). Preserving exact documents of foreign earnings and tax obligations paid is therefore essential to calculating the appropriate FTC and preserving tax conformity.

expatriates to decrease their tax obligations. As an example, if an U.S. taxpayer has $250,000 in foreign-earned revenue, they can leave out approximately $130,000 using the FEIE (2025 ). The remaining $120,000 may then undergo taxation, yet the united state taxpayer can possibly use the Foreign Tax obligation Debt to balance out the taxes paid to the foreign country.

Examine This Report on Feie Calculator

He sold his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to assist satisfy the Bona Fide Residency Examination. Neil aims out that purchasing property abroad can be challenging without initial experiencing the location."We'll definitely be outside of that. Also if we return to the United States for medical professional's visits or business calls, I doubt we'll spend greater than 30 days in the US in any kind of provided 12-month period." Neil highlights the value of stringent monitoring of united state sees. "It's something that people need to be truly persistent regarding," he claims, and encourages expats to be careful of typical errors, such as overstaying in the U.S.

Neil takes care to stress and anxiety to united state tax authorities that "I'm not carrying out any type of service in Illinois. It's simply a mailing address." Lewis Chessis is a tax obligation advisor on the Harness platform with considerable experience assisting U.S. citizens navigate the often-confusing realm of international tax conformity. Among the most typical mistaken beliefs among united state

Our Feie Calculator PDFs

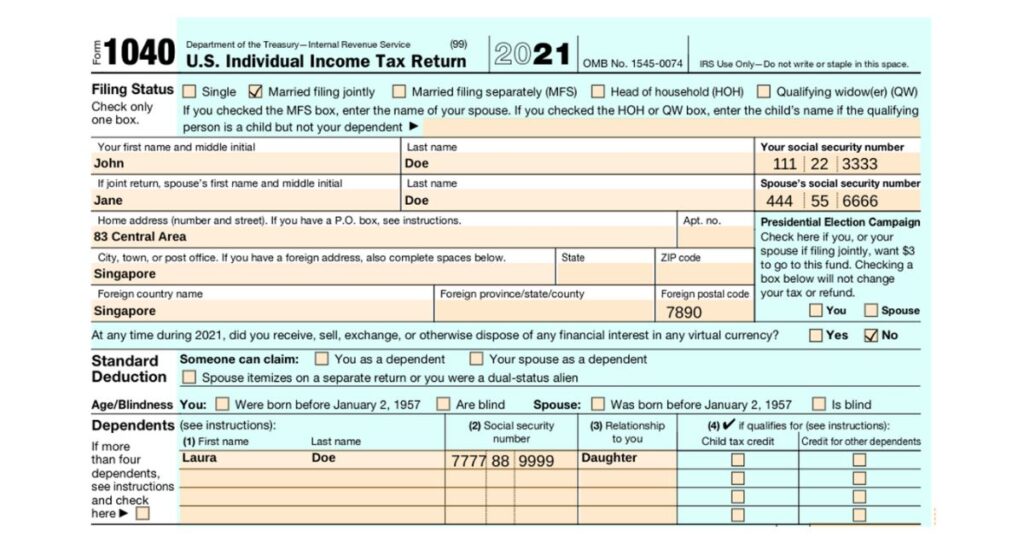

income tax return. "The Foreign Tax Credit allows people working in high-tax nations like the UK to counter their U.S. tax liability by the quantity they have actually already paid in tax obligations abroad," says Lewis. This guarantees that deportees are not taxed twice on the very same income. However, those in reduced- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

The prospect of lower living prices can be tempting, yet it usually comes with trade-offs that aren't quickly apparent - https://feiecalcu.carrd.co/. Real estate, for instance, can be a lot more cost effective in some nations, but this can suggest endangering on framework, safety and security, or accessibility to reliable energies and services. Cost-effective properties could be found in areas with inconsistent net, restricted public transport, or undependable health care facilitiesfactors that can considerably affect your everyday life

Below are a few of the most frequently asked concerns about the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) permits U.S. taxpayers to leave out approximately $130,000 of foreign-earned income from government earnings tax, reducing their U.S. tax obligation responsibility. To receive FEIE, you must fulfill either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Test (verify your primary home in an international country for a whole tax year).

The Physical Existence Examination also calls for U.S. taxpayers to have both a foreign earnings and an international tax obligation home.

Things about Feie Calculator

An income tax treaty between the U.S. and one more nation can help prevent double tax. While the Foreign Earned Income Exclusion reduces gross income, a treaty may offer additional benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed declaring for united state citizens with over $10,000 in foreign monetary accounts.

The foreign made income exemptions, often described as the Sec. 911 exemptions, omit tax on wages gained from working abroad. The exclusions consist of 2 components - an income exclusion and a real estate exemption. The adhering to Frequently asked questions review the benefit of the exemptions consisting of when both spouses are expats in a basic fashion.

10 Easy Facts About Feie Calculator Described

The revenue exemption is currently indexed for inflation. The optimal annual income exclusion is $130,000 for 2025. The tax obligation benefit omits the revenue from tax obligation at lower tax that site obligation prices. Previously, the exclusions "came off the top" reducing earnings based on tax obligation at the leading tax rates. The exclusions may or may not reduce income used for other purposes, such as individual retirement account restrictions, child credits, individual exceptions, and so on.These exclusions do not spare the wages from US taxes yet simply give a tax obligation decrease. Note that a bachelor functioning abroad for every one of 2025 that earned regarding $145,000 without any various other earnings will have gross income reduced to zero - efficiently the very same solution as being "free of tax." The exclusions are computed every day.

If you went to organization meetings or seminars in the United States while living abroad, income for those days can not be left out. For US tax obligation it does not matter where you maintain your funds - you are taxed on your around the world revenue as an US individual.

Report this wiki page